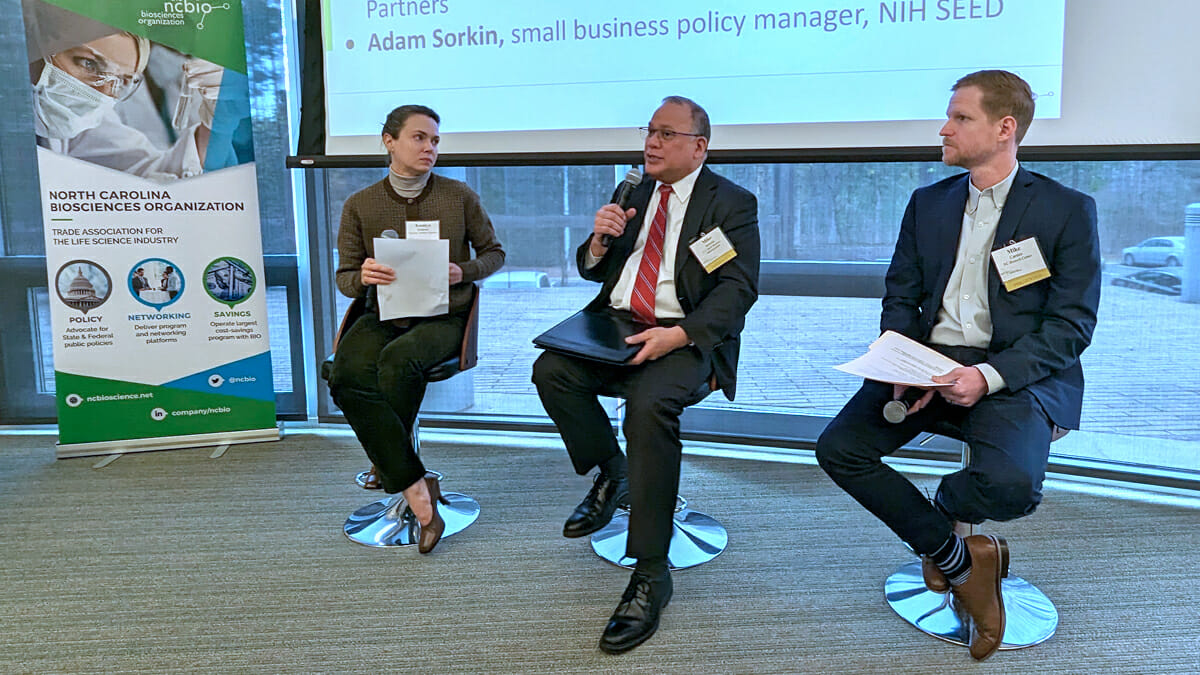

Panelists offer advice on funding options for emerging companies

Panelists at the NCBIO Emerging Companies Luncheon and Forum held Wednesday, March 22, at the NC Biotechnology Center offered insights into the way their organizations choose investments, when to seek SBIR funding, engaging with a funding agency for the first time and more.

The forum was sponsored by Clancy & Theys Construction Company, JBK Associates International, Nikon and SAS.

The panel was moderated by Kseniya Simpson, Ph.D., associate, Hatteras Venture Partners and included

- Mike Arriola, district director, NC Office, U.S. Small Business Administration;

- Mike Carnes, senior director of investments, NC Biotechnology Center;

- Alastair Monk, Ph.D., program director, National Science Foundation; and

- Adam Sorkin, small business policy manager, Small Business Education & Entrepreneurial Development Office, National Institute of Health.

How do you choose investments?

Simpson said that Hatteras’s sweet spot for investment is Series A, although they also invest in later stage companies. They tend to invest in preclinical therapeutic companies with proof of concept in an animal model, early clinical device companies with a nearly completed prototype and revenue-generating health care IT and services companies.

Hatteras may consider earlier stage companies if they have a platform with massive potential, she said. She advised companies to pay attention to investment guidelines and to avoid reaching out to an investor too early. Simpson suggested that entrepreneurial companies maximize their research dollars in order to move their programs forward.

Arriola said that having a healthy net worth on a company's balance sheet is important to lenders, especially for nondilutive funding. He also said that whether nondilutive funding can be used as a down payment on a loan depends on any restrictions placed on it. Overall, lenders prefer to see a strong balance sheet as it indicates potential for leveraging more debt.

Carnes stressed the importance of having a focused development strategy that aligns with reaching the next key value inflection point and externally validated steps to achieve them. He also recommended finding appropriate partners to outsource work to, such as CROs, to minimize overhead costs and maintain capital efficiency.

Finally, having a balanced strategy is crucial for managing monthly cash burn, especially during times of limited capital, he said.

When do you use the SBIR program to get additional funding?

Monk suggested that companies can take advantage of the SBIR program to acquire funding from multiple agencies to advance their technology but warned against duplicating or overlapping federal funding. He recommended reaching out to program directors during open office hours to address budget concerns and explore options for accessing expert, equipment or human resources to support research and development. On the micro level, it is important to carefully consider budget allocations when putting together a proposal, he said.

Simpson knowing when to pursue SBIR funding depends on the specifics. For therapeutics companies, she recommended focusing on validation and value inflection points and to conduct critical experiments efficiently. She also emphasized the importance of not being afraid to conduct experiments and gather data early.

On the budget side, Simpson advised stretching the budget as much as possible and taking advantage of ways to save money, while also being mindful of which corners are not worth cutting.

What’s your best advice for a company preparing for their first engagement with a potential funding agency?

“I think the first thing is to be crystal clear about your revenue stream,” Arriola said. “That's going to be probably the most important determining whether or not you get a loan or the equity or whatever from SBA.”

Carnes said a company must be able to clearly communicate its strategy and progress, including where it has been, where it is currently, and where it needs to go. It is important to be prepared to discuss these basic elements of the company and to polish the company's story before approaching funding resources such as SBIR, SBA or investors, he said. Working with advisers who have been through the specific type of funding process before can also help in communicating the most appropriate message.

Sorkin agreed and said, “Have a good idea of what your project is going to look like. It doesn’t need to be tremendously detailed, but have a clear idea of the unmet need you’re addressing and what your overall research goals and desired outcomes are.

“We fund specific projects, not just your company. Being able to give us a clear, high-level overview can help us make sure you’re in the right place.”

How has the market and funding environment changed in the aftermath of the pandemic?

Simpson said the pandemic has made investors raise the bar even higher in terms of what investors are looking for in companies. They are also thinking more about financial risk, not just technical risk, and having another co-investor involved with the company can help mitigate that risk.

Companies have been doing insider-led term sheets recently, which has helped catalyze things for companies that were having a harder time raising money, she said. The biggest challenge has been for Series B and C companies, which need a considerable amount of funding to progress their programs and feel the squeeze the most.

Carnes said, “As the funding market has slowed down, I think one of the things that it’s really going to take to jumpstart the investment landscape again will be to see more acquisitions, more midcap acquisitions. A lot of these but public and private traded large biotech companies are sitting on cash reserves.”

Arriola said the SBA provided $30 billion in financing to half a million small businesses across North Carolina through various relief programs during the pandemic. While there were flaws in their system due to the rapid implementation of the programs, they quickly made changes to improve efficiency and expand their network of lenders, including involving nontraditional lenders and fintechs.

In addition to providing COVID relief funding, the SBA in North Carolina exceeded $1 billion in non-COVID relief funding in 2021, and there was a surge in small business startups, with a record 178,000 new business filings in 2021. Despite the challenges of the pandemic, the North Carolina economy shows promising signs of small business development, he said.

The Franklin County Innovation Mobile Lab stopped by NC Biotech and the Emerging Companies Forum so that attendees could get a look at this mobile classroom created by the United Way and Novozymes.